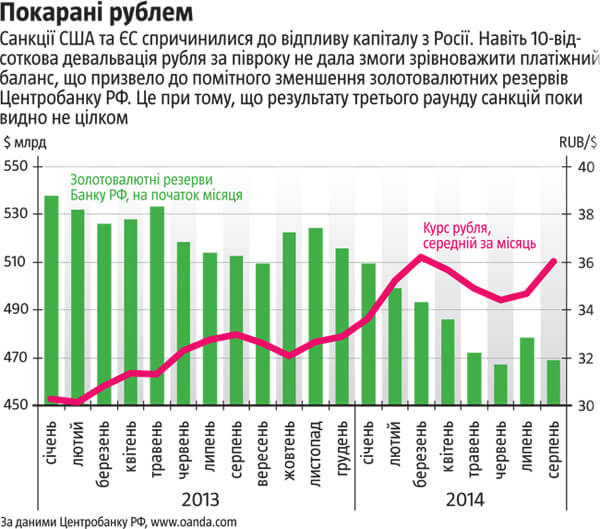

Sanctions are working: Economic stats show their impact

WE NEED YOUR HELP! 24/7, every day, since 2014 our team based in Kyiv is bringing crucial information to the world about Ukraine. Please support truly independent wartime Pulitzer Prize-winning journalism in #Ukraine.

You are welcome to fund us:

Share this:

0 Comments

Related Articles

You can back

Ukraine Front Lines

to remain #1 Independent Citizen Media about Ukraine. Your investment saves the Truth and lives.

About Ukraine Front Lines

Ukraine Front Lines is the Independent Citizen Media, which disseminates truthful news on the latest updates from Ukraine.