So we have very important news on the export of russian crude oil from the Black Sea.

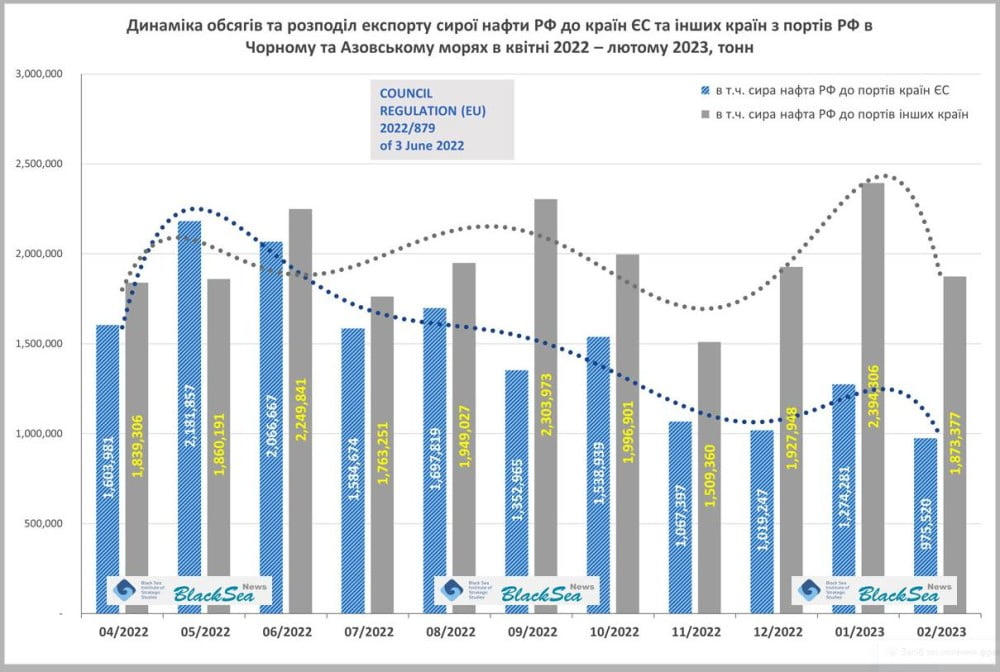

As of February 2023, the Monitoring Group of the Black Sea Institute of Strategic Studies recorded a decrease in russian crude oil exports by 22% (or by 800,000 tons by January 2023) – both to the EU and other countries, Andrii Klymenko says. But experience (or “inner voice”, if you like) prevented us from hastily starting to rejoice. And for good reason.

Only in the first 15 days of March 2023, the russian federation exported 120,000 more tons of crude oil from the Black Sea than in the whole (!) of February 2023 (2,969,748 and 2,848,897, respectively).

In the first half of March, only 16% of oil volumes were reloaded ship-to-ship in the Gulf of Laconia in Greece, and 84% – were exported to Asian countries.

That is, on the one hand, the EU embargo is working, because in February 34% of oil volumes were exported to the EU, and on the other hand, it looks like the russian federation did manage to redirect crude oil export flows from EU countries to Asian countries (in February – 66 %, in the first half of March – 84%).

We are not going to analyze the oil price. This is the task of experts in this market, and it is very complicated and controversial. But the fact of successful export reorientation already exists.

In addition, on the recent days, Bloomberg offers lots of positive news for Ukraine and negative news on oil prices, and of course it also concerns russia. Evgeniy Istrebin won’t quote them in full, only some excerpts from two articles, so let’s go:

“China’s reopening after years of anti-Covid lockdowns was inspiring predictions of a demand resurgence and price rally. Leading industry voices from trading house Trafigura Group to Goldman Sachs Group Inc. forecast a return to $100 a barrel.

Buzzing industry get-togethers from London to Houston advertised that the oil trade, having survived both the pandemic and the corporate ESG agenda, was back with a vengeance.

But in recent weeks, expectations for a boom have grown more sober.

First, China’s modest new targets for economic growth and a more hawkish tone of monetary policy from the Federal Reserve soured the mood.

Meanwhile, Russian supplies proved stubbornly resistant against international sanctions, helping to tip global markets into a deeper surplus, with inventories at an 18-month high.

Then came this week’s banking fiasco, which at its nadir dragged Brent crude almost to the threshold of $70 a barrel.

There are reasons to believe that – provided the financial turmoil doesn’t mutate into something more nasty – the selloff may be limited. Brent has steadied after this week’s rout, which was compounded by banks. Nonetheless, crude’s path back to $100 has, with the latest crisis, run into a major roadblock.”

————————–

“Across the world, there are increasing signs that the smooth flow of Russian petroleum is starting to get snarled.

Even after the world’s main oil forecasting agency said output could fall by 30%, exports from the OPEC+ producer have so far been resilient as the sanctions, along with price caps on Russian oil, were intended to keep the flow going. However, cargoes are now starting take longer in finding homes.

Ships filled with refined fuels are floating off the coasts of Europe, Africa and Latin America, potentially ratcheting waiting fees. Some vessels hauling OPEC+ producer’s crude oil are bouncing between ports without discharging, while others are unloading and being stashed at unusual locations.

It all points to a network of logistics that is struggling to keep pace with servicing a country that exports over 7 million barrels a day of crude oil and products. A vast swath of that trade has shifted from Europe to new and less familiar customers, often thousands of miles further away.

“There has already been a mismatch in what is leaving Russian ports and what is being imported by buyers of Russian oil,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “This is translating in higher volumes of oil on water, and considering a limited number of tankers available to transport oil, if those tankers are not unloaded, it will translate in lower exports and production at some point.”

Though it announced an output cut of 500,000 barrels a day for this month, Russia’s crude oil exports by sea have held up so far this month – a fact that has weighed on prices in recent weeks.

The question is whether that could unravel if deliveries drag.

About 1.2 billion barrels of crude oil were on the water last week, the highest for this time of the year in data going back to 2016, data from Vortexa Ltd. showed.

Two tankers that carried Russia’s flagship Urals crude to the mouth of the Persian Gulf have stayed put since they arrived months ago.

At least four tankers with the nation’s ESPO crude have waited for weeks with some visiting one Chinese port after another, while around 4.4 million barrels of diesel-type fuel from Russia were kept at sea in early March in the largest buildup in at least seven years.

“Willing buyers in Asia, namely India and, to a lesser extent, China, have snapped up discounted crude oil cargoes, but increasing volumes on the water suggest that the share of Russian oil in their import mix may be getting too big for comfort,” the International Energy Agency said in its monthly report this week.

With Asia still hovering up lots of Russian supply, the country is nevertheless having to turn to increasingly unusual places to stash its crude.

A vessel loaded with Russian crude has been idling off the coast of Ghana for almost three weeks, and another shipment was sent to the storage tanks in southeast Turkey late last month.

There’s also a growing buildup of refined petroleum, with millions of barrels of diesel-type cargoes temporarily stored.

One such ship, the SCF Yenisei carrying Russian diesel-type fuel, discharged a cargo after sitting off the coast of Ghana for more than 10 days.

Another, the Adamas I, which loaded Russian fuel in late January, has been floating off Sudan for over 20 days, according to Vortexa Ltd. and tanker tracking data compiled by Bloomberg.

“Although crude oil cargoes are finding new homes in China and India, products are facing increasing difficulties to be placed,” said Tamas Varga, an analyst at brokerage PVM.

If the EU and G7 don’t lower the price ceiling on russian oil, it will probably collapse on its own. I’ve always said that russia’s problem is russia itself. It’s too big to sell so much oil on the world market. And those volumes are going to end badly for them. Serves them right.

Tags: featured-1 russia ukraine war ukraine front lines